Mexico City, Mexico – March 22, 2024 -- Total Play Telecomunicaciones, S.A.P.I. de C.V. (“Total Play,” “we,” “us” or “our”) today announced the commencement of (x) an offer to exchange (the “Exchange Offer”) all of its validly tendered and accepted 7.500% Senior Notes due 2025 (the “Existing Notes”) for 10.500% Senior Secured Notes due 2028 (the “New Notes”) and (y) the solicitation of consents to the Proposed Amendments (as defined below) from the holders of Existing Notes (the “Consent Solicitation”), upon the terms and subject to the conditions set forth in the exchange offer and consent solicitation memorandum, dated March 22, 2024 (the “Exchange Offer and Consent Solicitation Memorandum”) and the related Eligibility Letter (together with the Exchange Offer and Consent Solicitation Memorandum, the “Offer Documents”). Capitalized terms not defined herein shall have the meaning ascribed to them in the Offer Documents.

Each Eligible Holder (as defined below) of Existing Notes that validly tenders Existing Notes in the Exchange Offer (and does not validly revoke such tender) shall be deemed to consent to amend (the “Proposed Amendments”) the indenture dated as of November 12, 2020, pursuant to which the Existing Notes were issued (the “Existing Notes Indenture”). The Proposed Amendments will among other matters, eliminate substantially all restrictive covenants, certain events of default and other provisions contained in the Existing Notes Indenture. Approval of the Proposed Amendments requires the consent of the holders of at least a majority of the outstanding principal amount of the Existing Notes; provided that any Existing Notes held by Total Play or its affiliates will be deemed not to be outstanding for these purposes.

THE EXCHANGE OFFER AND THE CONSENT SOLICITATION WILL EXPIRE AT 11:59 P.M. (NEW YORK CITY TIME) ON APRIL 18, 2024, UNLESS EXTENDED BY TOTAL PLAY IN ITS SOLE DISCRETION (SUCH DATE AND TIME, AS THEY MAY BE EXTENDED, THE “EXPIRATION DATE”). IN ORDER TO BE ELIGIBLE TO RECEIVE THE APPLICABLE EARLY TENDER CONSIDERATION (AS DEFINED BELOW), ELIGIBLE HOLDERS OF EXISTING NOTES MUST SUBMIT THEIR TENDER ORDERS AT OR PRIOR TO 5:00 P.M. (NEW YORK CITY TIME) ON APRIL 5, 2024, UNLESS EXTENDED BY TOTAL PLAY IN ITS SOLE DISCRETION (SUCH DATE AND TIME, AS THEY MAY BE EXTENDED, THE “EARLY TENDER DATE”). ELIGIBLE HOLDERS OF EXISTING NOTES WHO VALIDLY SUBMIT THEIR TENDER ORDERS AFTER THE EARLY TENDER DATE, BUT ON OR PRIOR TO THE EXPIRATION DATE WILL BE ELIGIBLE TO RECEIVE THE LATE TENDER CONSIDERATION (AS DEFINED BELOW). TENDER ORDERS MAY BE VALIDLY REVOKED AT ANY TIME PRIOR TO 5:00 P.M. (NEW YORK CITY TIME) ON APRIL 5, 2024 UNLESS EXTENDED BY TOTAL PLAY IN ITS SOLE DISCRETION (SUCH DATE AND TIME, AS THE SAME MAY BE EXTENDED, THE “WITHDRAWAL DATE”), BUT NOT THEREAFTER. THE DEADLINES SET BY ANY INTERMEDIARY OR RELEVANT CLEARING SYSTEM MAY BE EARLIER THAN THESE DEADLINES.

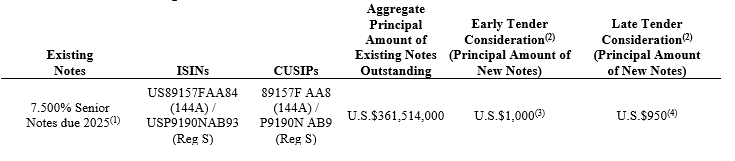

The following table sets forth the Exchange Consideration (as defined herein) Eligible Holders will be entitled to receive in connection with the Exchange Offer and the Consent Solicitation.

(1) The Existing Notes are currently listed and traded on the Singapore Exchange Securities Trading Limited.

(2) Per U.S.$1,000 principal amount of Existing Notes validly tendered and accepted for exchange. The Exchange Consideration (as defined below) does not include the Accrued Interest Payment (as defined below). No separate or additional consideration will be paid in connection with the Consent Solicitation.

(3) Holders of Existing Notes validly submitting Tender Orders at or prior to the Early Tender Date will receive for each U.S.$1,000 principal amount of Existing Notes validly tendered and accepted for exchange U.S.$1,000 principal amount of New Notes (the “Early Tender Consideration”).

(4) Holders of Existing Notes validly submitting Tender Orders after the Early Tender Date and at or prior to the Expiration Date will receive for each U.S.$1,000 principal amount of Existing Notes validly tendered and accepted for exchange, U.S.$950 principal amount of New Notes (the “Late Tender Consideration”).

Exchange Consideration and Accrued Interest Payment

Early Tenders of Existing Notes

Eligible Holders of Existing Notes who validly tender Existing Notes at or prior to the Early Tender Date will be eligible to receive, for each U.S.$1,000 principal amount of Existing Notes validly tendered and accepted for exchange, U.S.$1,000 principal amount of New Notes (the “Early Tender Consideration”).

Late Tenders of Existing Notes

Eligible Holders of Existing Notes who validly tender Existing Notes after the Early Tender Date but at or prior to the Expiration Date will be eligible to receive, for each U.S.$1,000 principal amount of Existing Notes validly tendered and accepted for exchange, U.S.$950 principal amount of New Notes (the “Late Tender Consideration”).

The Early Tender Consideration and the Late Tender Consideration together are referred to as the “Exchange Consideration.”

Accrued Interest on Existing Notes

In addition to the Exchange Consideration, Eligible Holders whose Existing Notes are accepted for exchange in the Exchange Offer will also receive all accrued and unpaid interest on the Existing Notes from the last interest payment date to, but not including the settlement date (such payment, the “Accrued Interest Payment”), to be paid in cash on the settlement date.

The Exchange Consideration will not include any payment or remuneration with respect to the consents to the Proposed Amendments.

Terms of New Notes

Principal and Interest Payments

Payments of principal of the New Notes will be made in 12 quarterly installments commencing on March 31, 2026, each equivalent to 5% during 2026, 7.5% during 2027 and 12.5% during 2028 of the adjusted principal amount of New Notes on the record date immediately preceding each March 31, June 30, September 30 and December 31, with a final maturity on December 31, 2028; provided that if (i) U.S.$180,000,000 or more aggregate principal amount of Total Play’s 6.375% Senior Notes due 2028 remains outstanding on May 31, 2028 or (ii) at any time there is an acceleration of any indebtedness of Total Play or the guarantor of the New Notes in a principal amount equal or greater than U.S.$20,000,000 (each of (i) and (ii), a “Springing Maturity Event”), then the remaining principal amount of the New Notes will be payable on the fifth Business Day after the date of notice to the holders of the New Notes of the occurrence of the Springing Maturity Event.

The New Notes will bear interest at a rate of 10.500% per year, payable quarterly in arrears on each March 31, June 30, September 30 and December 31 of each year, commencing on June 30, 2024.

Redemption

Upon occurrence of a public equity offering by Total Play at any time prior to July 1, 2025, Total Play may redeem up to 40.0% of the aggregate principal amount of the New Notes, at a redemption price equal to 110.500% of the principal amount thereof, plus accrued and unpaid interest, if any, to (but excluding) the redemption date and all additional amounts, if any, then due (subject to the rights of holders of New Notes on the relevant record date to receive interest and principal due on the relevant payment date), with the net cash proceeds of such public equity offering by Total Play; provided that: (i) at least 60.0% of the aggregate principal amount of the New Notes originally issued (excluding New Notes held by Total Play or its affiliates) remain outstanding immediately after such redemption; and (ii) the redemption occurs within 180 days of the date of the closing of such public equity offering.

At any time prior to July 1, 2025, Total Play may redeem all or a part of the New Notes, at a redemption price equal to 100.000% of the principal amount of the New Notes redeemed, plus an amount equal to, on any redemption date, the greater of (i) 1.0% of the principal amount of such New Notes; or (ii) the excess of: (a) the present value at such redemption date of (1) the redemption price of such New Notes at July 1, 2025 plus (2) all required interest payments due on such New Notes through July 1, 2025 (excluding accrued but unpaid interest to the redemption date), computed using a discount rate equal to the Treasury Rate as of such redemption date plus 50 basis points; over (b) the principal amount of such New Notes, and accrued and unpaid interest, if any, to (but excluding) the redemption date and all additional amounts, if any, then due (subject to the rights of holders of the New Notes on the relevant record date to receive interest and principal due on the relevant payment date).

Total Play may redeem all or a part of the New Notes, at a redemption price of (i) 105.250% of the principal amount of the New Notes if redeemed on or after July 1, 2025 and before July 1, 2026, (ii) 102.625% of the principal amount of the New Notes if redeemed on or after July 1, 2026 and before July 1, 2027, or (iii) 100.000% of the principal amount of the New Notes if redeemed on or after July 1, 2027, plus accrued and unpaid interest, if any, to (but excluding) the redemption date and all additional amounts, if any, then due, on the New Notes redeemed (subject to the rights of holders of New Notes on the relevant record date to receive interest and principal due on the relevant payment date).

In addition, Total Play may redeem the New Notes, in whole but not in part, at a price equal to 100.000% of the outstanding principal amount thereof plus any accrued and unpaid interest to (but excluding) the redemption date, together with any additional amounts, upon the occurrence of specified tax events.

Security and Collateral

Total Play’s obligation to pay principal and interest due under the New Notes will be secured by a security interest, established under a Mexican trust, in an earmarked portfolio of receivables from Total Play and its subsidiary Total Box, S.A. de C.V. and the related cash flows, and amounts deposited into a debt service reserve account established under the indenture pursuant to which the New Notes will be issued.

Expiration; Extension

The Exchange Offer and the Consent Solicitation will expire at 11:59 p.m. (New York City time) on April 18, 2024, unless further extended or earlier terminated by Total Play, who may extend the expiration time for any reason.

If Total Play decides to extend the Exchange Offer and the Consent Solicitation, Total Play will announce any extensions by press release or other permitted means no later than 9:00 a.m. (New York City time) on the business day immediately following the previously scheduled expiration time.

General

Subject to the terms and conditions set forth in the Exchange Offer and Consent Solicitation Memorandum, the Exchange Offer and the Consent Solicitation may be amended in any respect, extended or, upon failure of a condition to be satisfied or waived, terminated prior to the Expiration Date. If a material change in the terms of the Exchange Offer and the Consent Solicitation or the information concerning the Exchange Offer and the Consent Solicitation, or if there is a waiver of a material condition of the Exchange Offer and the Consent Solicitation, Total Play will disseminate additional materials relating to the Exchange Offer and the Consent Solicitation and extend the Exchange Offer and the Consent Solicitation to the extent required by law. If Total Play materially modifies or extends the terms of the Exchange Offer and the Consent Solicitation, Total Play will provide for reasonable revocation rights to any tendering holders. In the event that the Exchange Offer and the Consent Solicitation is terminated, Total Play will give notice thereof to the Exchange and Information Agent and will make a public announcement.

Eligible Holders of Existing Notes are advised to check with any bank, securities broker or other intermediary through which they hold Existing Notes as to when such intermediary would need to receive instructions from an Eligible Holder in order for that Eligible Holder to be able to participate in, or withdraw their instruction to participate in, the Exchange Offer before the deadlines specified in the Offer Documents. The deadlines set by any such intermediary, or, as the case may be, as imposed by DTC, Euroclear or Clearstream, may vary from the deadlines specified in the Offer Documents and this announcement.

Ipreo LLC will act as the Exchange and Information Agent in connection with the Exchange Offer and the Consent Solicitation. Jefferies LLC will act as Dealer Manager and Solicitation Agent in connection with the Exchange Offer and the Consent Solicitation. Questions regarding the terms of the Exchange Offer and the Consent Solicitation may be directed to the Exchange and Information Agent at the address below. The Exchange Offer and Consent Solicitation Memorandum may be obtained from the Exchange and Information Agent.

Important Notice

This announcement is not an offer of securities for sale in any jurisdiction where it is unlawful to do so and the New Notes have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction of the United States. Total Play is offering the New Notes (1) in the United States, only to “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) in private transactions in reliance upon the exemption from the registration requirements of the Securities Act provided by Section 4(a)(2) thereof and (2) outside the United States in reliance on Regulation S under the Securities Act to (i) non-U.S. persons (as defined in Rule 902 under the Securities Act), (ii) not acting for the account or benefit of a U.S. person and (iii) who are “Non-U.S. Qualified Offerees”.

Only holders of Existing Notes who have returned a duly completed Eligibility Letter (which can be obtained from the Exchange and Information Agent) certifying that they are within one of the categories described in the immediately preceding sentence are authorized to receive and review the Exchange Offer and Consent Solicitation Memorandum related to the Exchange Offer and the Consent Solicitation and to participate in the Exchange Offer and the Consent Solicitation (“Eligible Holders”).

The distribution of materials relating to the Exchange Offer and the Consent Solicitation may be restricted by law in certain jurisdictions. The Exchange Offer and the Consent Solicitation are void in all jurisdictions where they are prohibited. If materials relating to the Exchange Offer and the Consent Solicitation come into your possession, you are required to inform yourself of and to observe all of these restrictions. The materials relating to the Exchange Offer and the Consent Solicitation, including this announcement, do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If a jurisdiction requires that the Exchange Offer be made by a licensed broker or dealer and the Dealer Manager and Solicitation Agent or any of its affiliates is a licensed broker or dealer in that jurisdiction, the Exchange Offer and the Consent Solicitation shall be deemed to be made by the Dealer Manager and Solicitation Agent or such affiliate on behalf of Total Play in that jurisdiction.

All statements in this announcement, other than statements of historical fact, are forward-looking statements. Specifically, Total Play cannot assure you that the proposed transactions described above will be consummated on the terms currently contemplated, if at all. These statements are based on expectations and assumptions on the date of this announcement and are subject to numerous risks and uncertainties which could cause actual results to differ materially from those described in the forward-looking statements. Risks and uncertainties include, but are not limited to, market conditions, and factors over which Total Play has no control. Total Play assumes no obligation to update these forward-looking statements, and does not intend to do so, unless otherwise required by law.

None of Total Play, the Dealer Manager and Solicitation Agent, the Existing Notes trustee, the New Notes trustee, the Collateral Trustee or the Exchange and Information Agent makes any recommendation as to whether or not Eligible Holders of Existing Notes should exchange their Existing Notes in the Exchange Offer and the Consent Solicitation.

None of the U.S. Securities and Exchange Commission or any other regulatory body has registered, recommended or approved the issuance of the New Notes or passed upon the accuracy or adequacy of the Exchange Offer and Consent Solicitation Memorandum. Any representation to the contrary is a criminal offense.

THE INFORMATION CONTAINED IN THIS DOCUMENT IS TOTAL PLAY’S EXCLUSIVE RESPONSIBILITY AND IT HAS NOT BEEN REVIEWED OR AUTHORIZED BY THE NATIONAL BANKING AND SECURITIES COMMISSION (COMISIÓN NACIONAL BANCARIA Y DE VALORES, OR THE “CNBV”). THE NEW NOTES HAVE NOT BEEN AND WILL NOT BE REGISTERED WITH THE NATIONAL SECURITIES REGISTRY (REGISTRO NACIONAL DE VALORES, OR THE “RNV”) MAINTAINED BY THE CNBV, AND, THEREFORE, MAY NOT BE PUBLICLY OFFERED OR SOLD OR OTHERWISE BE THE SUBJECT OF BROKERAGE ACTIVITIES IN MEXICO, EXCEPT THAT THE NEW NOTES MAY BE OFFERED IN MEXICO, ON A PRIVATE PLACEMENT BASIS, TO PERSONS THAT ARE INSTITUTIONAL INVESTORS (INVERSIONISTAS INSTITUCIONALES) OR ACCREDITED INVESTORS (INVERSIONIONISTAS CALIFICADOS), PURSUANT TO THE PRIVATE PLACEMENT EXEMPTION OF ARTICLE 8, SECTION 1 OF THE MEXICAN SECURITIES MARKET LAW (LEY DEL MERCADO DE VALORES, OR THE “MEXICAN SECURITIES MARKET LAW”) AND THE REGULATIONS THEREUNDER. AS REQUIRED UNDER THE MEXICAN SECURITIES MARKET LAW, WE WILL NOTIFY THE CNBV OF THE OFFERING AND ISSUANCE OF THE NEW NOTES OUTSIDE OF MEXICO, AND THE MAIN TERMS OF THE NEW NOTES. SUCH NOTICE WILL BE SUBMITTED TO THE CNBV TO COMPLY WITH ARTICLE 7 OF THE MEXICAN SECURITIES MARKET LAW, FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT IMPLY ANY CERTIFICATION AS TO THE INVESTMENT QUALITY OF THE NEW NOTES, OUR SOLVENCY, LIQUIDITY OR CREDIT QUALITY OR THE ACCURACY OR COMPLETENESS OF THE INFORMATION SET FORTH HEREIN. THE ACQUISITION OF THE NEW NOTES BY ANY INVESTORS, INCLUDING ANY INVESTOR WHO IS A RESIDENT OF MEXICO, WILL BE MADE ON SUCH INVESTOR’S RESPONSIBILITY.

Note to Eligible Holders in the European Economic Area (the “EEA”) - Prohibition of sales to EEA Retail Investors

The New Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, (i) a “retail investor” means a person who is one (or more) of the following: (a) a retail client as defined in point (11) of Article 4(1) of MiFID II; (b) a customer within the meaning of the Insurance Distribution Directive, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (c) not a qualified investor as defined in the Prospectus Regulation; and (ii) “offer” includes the communication in any form and by any means of sufficient information on the terms of the Exchange Offer and the New Notes to be offered so as to enable an investor to decide to acquire the New Notes in the Exchange Offer. Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. The Exchange Offer and Consent Solicitation Memorandum has been prepared on the basis that any offer of New Notes in any member state of the EEA will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of notes. The Exchange Offer and Consent Solicitation Memorandum is not a prospectus for the purposes of the Prospectus Regulation.

Note to Eligible Holders in the United Kingdom (the “UK”) - Prohibition of sales to UK Retail Investors

The New Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For the purposes of this provision, (i) a “retail investor” means a person who is one (or more) of the following: (a) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the EUWA; (b) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA; or (c) not a qualified investor as defined in the UK Prospectus Regulation; and (ii) “offer” includes the communication in any form and by any means of sufficient information on the terms of the Exchange Offer and the New Notes to be offered so as to enable an investor to decide to acquire the New Notes in the Exchange Offer. Consequently, no key information document required by the PRIIPs Regulation as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation. The Exchange Offer and Consent Solicitation Memorandum has been prepared on the basis that any offer of New Notes in the UK will be made pursuant to an exemption under the FSMA and the UK Prospectus Regulation from the requirement to publish a prospectus for offers of notes. The Exchange Offer and Consent Solicitation Memorandum is not a prospectus for the purposes of the UK Prospectus Regulation.

About Total Play

Total Play is a leading telecommunications company in Mexico, which offers internet access, pay television and telephony services, through one of the largest 100% fiber optic networks in the country.